You’re a business owners with years of experience in the industry. So you make decisions based on your instinct. This is natural and has served you well in the past. But when the stakes are high and the costs of failure loom large, relying solely on common sense is risky.

That’s where market research comes in.

Market research involves collecting and analysing information from a variety of sources:

- Published data and reports

- Observing customer behaviors

- Direct communication through surveys, interviews, etc.

Market research helps reduce risks by giving you reliable data to base decisions on. It helps you understand your customers and potential customers’ needs, behaviours, and attitudes.

With that knowledge, you can make informed decisions and avoid costly mistakes.

Even the candle sellers at your local craft fairs do basic market research. They’re not conducting surveys or focus groups. But they’re watching competitor’s prices. Noting what grabs a customer’s attention. Quickly copying good ideas. If they didn’t keep a close eye on the market, they wouldn’t make any money.

Table of Contents

Why You Need Market Research

Market research is fundamental for one key reason: It helps you truly understand your markets. With that knowledge, you can make smart decisions about your business’s future direction.

Want to increase profits? A pricing survey gives you the data to make informed pricing decisions. Considering workforce changes? An employee survey provides valuable insights. Planning next year’s sales budget? Surveying customers helps you gauge market potential.

Understanding your market

Without knowing your market’s size, you’re operating almost blind. It’s difficult to understand your position in the market and the remaining growth potential if you don’t have a clear picture of the full market.

That’s why you need to know two key measures:

- Total Addressable Market (TAM): The total market demand for a product or service

- Served Available Market (SAM): The portion of TAM that you can realistically target

Understanding your customers

To increase your profit, you must understand your customers.

- Two-thirds of customers say, they spend more with companies that deliver a positive experience.

- Over half of people recommend a company based on experience, not just price or product.

- Almost everyone shares their bad experiences to warn others.

While every customer is unique, groups of consumers share similar characteristics in terms of their demographics, behaviours, and needs.

This is market segmentation. It is essential for effective marketing. It allows you to identify customer groups to target and customers not worth targeting.

You can segment your customers on three different levels.

The most basic is demographic segmentation. It is based on factors like age, gender, income, and location.

The next level is behavioural segmentation. This data on how customers actually behave is more difficult to obtain, as it’s not public information. But behavioural insights can be marketing gold.

Imagine you run a supermarket. Knowing when people buy wine lets you send targeted promotions at the perfect moment. Do wine buyers also purchase specific foods? You can place those items near the wine section and boost sales.

The most powerful (and difficult) type of segmentation is understanding customers’ needs – both met and unmet. If you can identify and group customers by their underlying needs, you can position your products perfectly to sell more.

Take the auto industry. Car owners have wildly different needs from their vehicles. Some need family haulers. Others want eco-friendly options. Many see their car as a status symbol.

Now imagine if an automaker truly understands those distinct needs. They can create marketing materials that resonate deeply with each group’s specific wants and desires. This would blow away generic “buy our car” campaigns aimed at everybody.

Developing new offers

Launching new products requires a major investment. To avoid costly misfires, you can do market research to test customer reactions before developing it.

Market research also allows you to identify ideal pricing, and refine marketing messages. With these insights, you can iterate your offering to ensure it delivers what your target market actually wants.

The biggest companies have entire teams for marketing research. Take Spotify. They have over 600 million active users and 239 million paid subscribers. They can’t afford to operate blindly.

Their consumer insights team have dozens of members with a range of qualitative and quantitative expertise. They don’t view consumer research as a nice-to-have. They see it as essential for acquiring and retaining over 200 million paying subscribers in an immensely competitive market.

What’s Worth Researching?

As a business owner, you constantly have to address new opportunities and problems. A new product could open new revenue streams – or just burn cash and tarnish your reputation. A drop in sales may signal an outdated lineup. Or it could simply be a competitor launching a price war.

These types of issues raise critical questions that must be answered before making major decisions. Market research can provide those answers.

That said, not every business decision requires market research. Daily choices around packaging, product improvements, pricing, and promotions don’t need in-depth studies. Doing market research for every minor decision would be impractical.

The market research brief

Your market research study will only be as good as the brief. The brief outlines the specific objective driving the project. When preparing the brief, carefully consider questions like:

- What’s the objective, and what action will be taken with the findings? Only include objectives tied to actionable insights you truly need, not just “nice to know” information. Don’t waste time & money on interesting data points. Seek “actionable” data.

- Who are the precise target groups for the research? Define whether they should be current customers, prospective buyers, influencers in the purchasing process, frequent purchasers, etc.

- What specific information do you need? For example, market size, trends, buying behaviours, customer satisfaction or needs, market segmentation, or something else.

- What relevant knowledge already exists? Build on existing data or past research. Don’t waste time re-establishing it.

How much accuracy do you need?

A high degree of accuracy isn’t always necessary. Greater precision comes at a higher price – as accuracy increases, costs rise disproportionately.

If you’re entering a clearly massive new market, you don’t need to pinpoint the exact size. A reasonable approximation could suffice.

For example, if your goal for a new market is $1 million in annual sales, you don’t need to know whether the total market size is $100 million or $150 million. Don’t pay a premium for unnecessary levels of accuracy. Spend that money elsewhere.

Leverage Existing Research

Before doing market research research, check which secondary data already exists. Information in the public domain or within your own company’s database is nearly always faster and less expensive to access.

The internet offers a vast array of existing data on market size, trends, competitors, distribution channels, market dynamics, and more. There’s no need to recreate these data.

Existing research example: UK cosmetics trends

Research firms like Mintel offer market intelligence across industries and countries. Here’s an example of summary data on recent UK cosmetics trends:

“The trend of cosmetic minimalism has started taking over in the last few years. This shift is seeing beautiful nude tones making a comeback and base make-up that promises a ‘glow from within’ rather than a streak of highlight that could be its light source.

“Though the narrative on skin cosmetics has changed in that people are less likely to be wearing full-face looks, people are still spending the most on this category. This could be due to a call for lighter and better quality formulas which translates to more expensive products. We can see this surge in quality over quantity in the types of base make-up being bought. In our UK Colour Cosmetics report, we found that 37% of women buy liquid/cream foundation but only 6% are spending on contouring products. This reflects an attitude shift where ‘less is more’ is a priority.”

Mintel regularly publishes multi-hundred-page reports with granular data.

If you’ve been in business for any length of time, you likely possess valuable proprietary data as well. One of the richest sources is your customer and sales databases. With some creative analysis, this data can provide powerful insights into your customer base, behaviours, and more.

Besides Google searches, you can check out these valuable sources of existing secondary data:

Government statistics

stats.oecd.org – The Organization for Economic Cooperation and Development provides data for rich countries covering GDP, labour markets, economic indicators and more.

commerce.gov – The U.S. Department of Commerce offers a vast trove of information from industry statistics and economic analysis to demographic data and research publications.

ec.europa.eu/eurostat/ – Eurostat, the European Union’s statistics office, has reliable data for all 27 EU countries.

Search your country’s government website. Almost every government in functioning countries offer reliable data across a range of issues.

Market reports

There are market research companies that produce comprehensive reports on various products and markets. They don’t tend to be too expensive. These reports can be a useful and inexpensive introduction to a new subject.

One prime source is MarketResearch.com. They have nearly a million market research reports from hundreds of leading global publishers.

There are also other sources:

- Euromonitor produces reports on European and global markets.

- Mintel produces reports on global consumer markets.

Trade and industry bodies

Nearly every industry has a collective association representing its interests. To serve members and for PR, they regularly publish information about their particular trade.

These associations may offer the data for free, or in some cases require a small fee. There are often online directories of these associations.

For example:

[sc name=”wpblitz_inside_post”][/sc]

Directories and lists

Directories are helpful for finding individuals or organisations. In the USA, Yellow Pages has one of the most comprehensive listings of small and medium-sized businesses across industries.

For a global view, Kompass catalogues millions of companies across 70+ countries worldwide. They include addresses, contact details and more detailed profiles on many.

Within Europe, Europages provides a well-established directory covering 2.6 million companies’ basic profiles spanning 30 nations.

Profilers

Companies like CACI gather vast demographic and lifestyle data on millions of individual consumers. This allows them to classify every neighbourhood in Britain into one of six categories, 18 groups and 62 distinct types.

They combine this base data with an organization’s customer database to segment existing customers by variables like lifestyle and income profiles.

The result? The ability to hyper-target offerings and messaging to specific customer segments with pinpoint accuracy.

Profilers can also identify prospective customers matching the demographics and characteristics of your current customer base – a powerful tool for acquisition.

Qualitative secondary data

Beyond numbers and statistics, qualitative sources offer rich consumer insights.

There are many magazines that cater to distinct demographic groups and product interests. These lifestyle outlets, easily accessible online, can be especially useful for consumer marketing research.

For example, if you want to research issues important to retirees, check out a popular retiree magazine. Examining just the table of contents would uncover a wealth of information.

If you are running a travel agency, you may notice that many magazines are talking about a new location. This may signal an opportunity for new tour packages.

Don’t forget online sources. Facebook groups, LinkedIn groups, forums, and subreddits provide additional windows into consumer psyches.

Combining secondary and primary data

You need to use secondary data to design primary research. Let’s say your company faces declining yogurt sales. Your first question: is overall yogurt consumption dropping, or are consumers simply not buying from your brand?

You can conduct a study of all yogurt eaters in the country. But that would be enormously expensive and time-consuming. Fortunately, that is often unnecessary if secondary data already exists.

Examine any available yogurt market data from government agencies, health associations, or industry groups. This data may reveal yogurt consumption is actually rising overall.

If so, your sales is declining because consumers are choosing other brands. With that key context, you can then design primary research to find out why consumers aren’t choosing your product.

Quantitative and Qualitative Research

There are two fundamental types of market research data: quantitative and qualitative.

Quantitative research involves precise measurement and data points like market size, segment shares, brand awareness levels, purchase frequencies, distribution statistics, and so on.

Qualitative research focuses on the “why” – understanding underlying attitudes, opinions, motivations, and beliefs driving consumer behaviour. For example, quantitative data may show ad A outperformed ad B, but qualitative insights explain why ad A resonated better.

You should use qualitative research when you need to understand the motivations behind consumer choices, uncover new opportunities, or explore general sentiment on a topic.

You can do qualitative research by interviewing people, holding focus groups or just observing. They all let participants provide raw, unstructured feedback in their own words or actions.

There’s no firm divide separating quantitative from qualitative sample sizes. Anything less than 30 to 50 is typically qualitative. Anything over 100 enters quantitative territory.

Many businesses rely solely on surveys for market research. This is unfortunate as the type of information that surveys can provide is limited. Surveys struggle to uncover the underlying motivations behind consumer decisions. Because consumers are often unaware of their own implicit reasoning.

Qualitative methods like dept interviews and focus groups can help you discover these types of information.

When should you do qualitative research?

Qualitative research can help you in three areas: exploratory research, building a picture of a market and new product development.

Exploratory research

Exploratory research helps you deeply understand your customers’ attitudes, emotions, preferences, and behaviours. Exploratory research can reveal:

- How customers perceive your product/product category (e.g. do they see granola bars as snacks, meal replacements, or other?)

- Customer segments (e.g. how to segment mobile phone users)

- Why customers prefer one brand over another (e.g. Coke vs Pepsi)

- Their decision-making process (e.g. what do they think about when selecting birthday cards?)

- Their behaviour (e.g. what would make them change their mobile phone network)

- Ideas to improve your offerings (e.g. what improvements would they like to see in the service they receive from a bank)

Building a picture of a market

In-depth expert interviews can help you understand a market’s size and structure, competitive environment, and growth prospects. You’ll be able to build a picture of the market through only a handful of interviews.

New product development

Qualitative research can help you gauge reactions to new product concepts and designs customers haven’t seen before. You can also find out potential weaknesses, likely interest level, potential target market, and suggested improvements or developments of the concept.

In the later stages, you can use qualitative methods to test reactions to prototypes and their packaging.

Depth Interviews

Depth interviews are unstructured, one-on-one conversations that dive deep into how and why people think, feel and act. Unlike surveys, they follow a flexible discussion guide, not a rigid script. Without a script, you can really explore responses through probing follow-up questions.

These interviews typically last 20-30 minutes or longer. This allows the interviewer to build rapport and gain the respondent’s trust to uncover their true opinion. The interview can be face-to-face or by phone.

Face-to-face offers advantages in watching body language and allowing time to pace the discussion. Phone interviews are more restrictive. It demands quicker responses and abhors the vacuum of silence. The respondents don’t get any time to think. It’s also harder to hold focus beyond 30-40 minutes on the phone.

Depth interviews can be carried out individually or in pairs. Only use paired interviews when both individuals are jointly involved in the topic area. A husband and wife may be interviewed as a pair about mortgage choices. This allows you to assess how they influence each other’s attitudes and behaviour.

As few as 10 depth interviews can be enough. Around 30 is typically the maximum needed to draw out all the key factors.

You should record all the interviews for analysis. But if you are conducting over 10 interviews, take notes during the interview. Analysing dozens of recorded conversations is difficult and time-consuming.

How to conduct depth interviews

Prepare a topic guide that outlines the issues you want to explore. This guide should contain a list of topics, not predetermined questions. Use it as an outline for the interview. Don’t show it to the respondent.

Use the guide as a flexible framework. There is no need to follow it to the letter. Constantly probe respondents to uncover their true thoughts and feelings on each topic.

Example topic list for an interview on fashion store layout

Introduction

- Welcome and explain the interview’s objective

- Provide an estimation of the interview length

- Obtain consent to record the interview

Existing behaviour

- How often do you visit the store?

- Average time spent in the store

- Frequency of purchases versus browsing

- Types of products purchased

- Purchases made at other fashion stores

- Reasons for visiting other fashion stores

Attitudes towards elements of the store design

- Layout

- Lighting

- Ease of finding products

- Changing rooms

- Availability of mirrors

Attitudes towards the overall feel of the store

- Brand/store perception (welcoming, exciting, modern)

- What they think the target customers are (age range, income level, interest in fashion)

- Comparison to other fashion stores (H&M, Zara)

Summary of satisfaction with store design

- Overall likes about the store design

- Areas needing improvement

- Additional comments about the store design and layout

Don’t ask long, complex questions that can confuse respondents. For example, “What do you think about the range of prices and products available to you now, in the DIY stores and the supermarkets compared with a few years ago?” Break it down into simpler, more focused questions.

Avoid technical jargon that your respondents may not understand. For instance, don’t ask, “Have you got any use for SMS or GMS telemetry?”

Avoid leading questions that suggest a specific answer. For example, don’t ask, “So you think Shell is a good supplier of LPG?” Such questions can bias the responses.

Interviewing industry experts

If you want to interview industry experts, try emailing them or contacting them on LinkedIn. Many will be willing to talk. Attending industry events and networking can also be helpful.

Keep in mind that industry experts are often busy. If you have difficulty connecting with them, join industry-specific Facebook, LinkedIn groups. For example, if you’re starting a roofing business, look for Facebook groups. You’ll find many groups with thousands of roofing business owners. Join these groups and ask your questions.

Ask interesting, specific questions that only experienced business owners can answer. You’ll get many helpful responses. Reach out privately to those who respond.

Focus Groups

Focus groups are depth interviews conducted with a small group of 5-10 respondents. A moderator leads the discussion.

The interaction within the group fosters a shared experience. It encourages participants to mention ideas and thoughts that might not emerge in individual interviews. Listening to others’ answers gives participants time to reflect and make more insightful comments.

Debates can arise when participants hold opposing views, further enhancing the understanding of the subject.

When to use focus groups

Focus groups are an excellent tool for generating new ideas. You have product development and marketing expertise. But it’s the customers who ultimately decide what to buy. So asking customers for feedback can be extremely helpful.

Focus groups are also effective for brainstorming promotional campaigns, crafting marketing messages, and selecting the right media channels.

Focus groups also explain the “why” behind problems. For instance, if a product isn’t performing well in the market, simply asking why might reveal that consumers dislike the taste. However, this feedback alone isn’t sufficient to make improvements. Focus groups help you uncover what specifically about the taste is unappealing and what changes could make a difference.

For service-related issues, customers might report that the staff was rude. But what specific behaviours led to this perception? Focus groups can help you find out, allowing you to address the problem effectively.

A key advantage of focus groups over surveys is the ability to ask follow-up questions. If a participant mentions they don’t “like” a product, you can dig deeper to understand if the issue is with the colour, size, taste, packaging, or cost. You can find out what they prefer instead.

How to set up a focus group

Setting up a focus group requires careful planning. You’ll need to find participants, pay them for their time, and reserve a meeting space. Participants will need to travel to your location and spend 1-2 hours of their weekend. So expect to pay each participant $75-$150.

Traditionally, focus groups are held in comfortable locations for participants, such as homes located in the same area or hotels for business people.

Only consider a focus group if you have enough potential respondents within a reasonable distance. You’ll need at least 50 prospects within about 30 minutes of travel time. Otherwise, you’ll find it difficult to get eight people to attend at the appointed time and date.

Participants should be interested in your business or industry. For example, if you’re creating accounting software, hiring people who have no interest or need for accounting software will not provide useful feedback.

There are a few ways to recruit participants:

- Handpick People You Know: Invite individuals who are interested in your industry or product.

- Reach Out to Existing Clients: Your current customers can provide valuable insights.

If Colgate wants to research a new toothpaste for sensitive teeth, they might seek adults aged 18 to 45 who frequently buy and use specific brands of toothpaste for sensitive teeth. Don’t make the criteria too narrow. This can make it difficult to find suitable participants.

Ideally, participants should not know each other. But if you can’t find enough participants, you can pick people you’ve met at meetups or networking events.

After securing commitments from participants, follow up before the event to confirm attendance. Factors like bad weather, illness, and emergencies can impact turnout. Recruit a few more people than you need. If everyone turns up, you can pay a couple of participants and ask them to leave to keep the group size manageable.

There are no strict rules for how many focus groups you need to hold. One focus group might provide the right answer, but you wouldn’t know for sure. Two focus groups could produce conflicting results. To get a more accurate and unbiased response, conduct three or four focus groups.

The topic for discussion

Prepare a discussion guide beforehand and use it to ensure all important topics are covered.

Discussion guide example

This is a real guide used to explore hotel guests’ attitudes towards various attributes provided by a hotel during a weekend stay.

Introduction (10–12 minutes)

- Welcome participants and explain the nature of the discussion

- Describe the research objective

- Outline the session format

- Have participants introduce themselves

Ease of obtaining information/booking prior to arrival (10 minutes)

- Type and source of information used and required before booking

- Methods of contact: phone, internet, email, coupon response, travel agents

- Information required over the phone and in booking confirmations

- Ask for examples of good and disappointing contact experiences

Quality of accommodation (40 minutes)

What makes a good impact/bad impact (obtain examples)?

- On arrival and before entering the hotel

- Upon entering the reception area

- The bedroom:

- What makes a bedroom comfortable

- Cover topics like the bathroom, bed, bedding, cleanliness, temperature control, TV, radio, lighting, minibar, storage space, phone, decor, security, tea/coffee facilities, toiletries, etc.

- Expectations of room service

- Ask examples of bedrooms that exceeded or fell short of expectation

- Dining and Bar Facilities: What enhances or detracts from the experience

- Leisure Facilities: What is required and what service is expected/level of use

- Departure: Good and bad experiences of checking out

- Other accommodation features

Overall value for money (10 minutes)

- Perceptions of what constitutes value for money.

Summary of satisfaction criteria (10 minutes)

- Key factors affecting overall satisfaction

- Check to see if anything was left unsaid that is important

Always start by having participants introduce themselves. You can also ask them to share their experiences related to the topic. This helps break the ice and makes everyone feel at ease.

Don’t ask questions that can be answered with a simple yes or no. You need to explore the topic from multiple angles. So encourage members to comment, debate and adjust their views.

During the session, you can watch how participants use your product or a current solution your product aims to replace. This can reveal new ideas you may have overlooked.

Run your focus group for 60, 90, or 120 minutes. Longer sessions can lead to fatigue and reduced quality of discussion.

[sc name=”wpblitz_inside_post”][/sc]

Online focus groups

Traditional focus groups can be challenging to conduct, especially when the target audience is small. This is common in many B2B markets. This is where online focus groups come into play.

Online focus groups operate similarly to their offline counterparts. But you don’t have the geographic limitations. Participants from across the country or even globally can take part. This is particularly helpful for markets with widely scattered audiences.

Another popular format is the bulletin board focus group. Instead of a Zoom call, participants engage in a forum or chat room over two to three days. They log in at their convenience to see questions, read others’ responses, and contribute their own insights.

The flexibility is a huge benefit. Participants and moderators don’t need to be online simultaneously.

Bulleting boards also offer more time for reflection. Unlike face-to-face sessions that last about two hours, participants can reflect and think deeply about the issue. You’re more likely to get thoughtful and genuine responses.

Observation Research

Observation research involves gathering data by watching people, objects, and organizations without directly interacting with them. You can observe directly or use camera.

Another form of observation is monitoring online activity on platforms like Facebook, Twitter, blogs, and YouTube.

Observation can be broad and quantitative, covering many events or people. It can also be focused and qualitative, offering in-depth insights from a smaller number of observations.

Observation reveals what people are doing. It doesn’t uncover the reasons behind their actions. But it can be valuable in many complex scenarios.

Grohe, a German shower manufacturer, held workshops to observe installers fitting various shower models. This led to the creation of an easy-fix kit, simplifying the installation process.

In another observational research, Adidas noticed that kids often left their shoelaces untied. This accidental insight inspired the launch of a highly successful shoe with a Velcro strap.

Marks & Spencer uses its Oxford Street store to observe customer reactions to new designs. This allows for quick decisions on whether to launch or discontinue a product.

An extension cable manufacturer believed in-store displays were affecting his sales. He hired researchers to visit stores and take photos. The images showed cable reels were often jumbled on the floor, because their flanges weren’t flat and wouldn’t stack. He redesigned the reels to make them stackable. This improved store presentation and boosted sales.

Mystery shopping

Mystery shopping involves you posing as customers to evaluate the processes of service delivery. It’s widely used in financial services, retail, car dealerships, hospitality, transportation, utilities, and government sectors.

The focus is on observing the actual service experience, noting which activities and procedures occur rather than collecting opinions about the service.

Customer satisfaction surveys can provide some light service delivery. But they don’t provide enough detail to identify and correct all service delivery weaknesses.

How to Select People for Qualitative Research

Selecting the right participants is crucial. When choosing participants, consider three main factors: their demographic and psychographic traits, knowledge of the research issue, and geographic location.

Demographic traits include age, gender, income, and education. Psychographic traits cover lifestyle, attitudes, opinions, and values. Geographic location is also important. Additionally, consider participants’ product knowledge or usage patterns, especially if the research distinguishes between non-users, occasional users, and heavy users.

The description of necessary characteristics for selecting participants is known as the participant profile.

If you want to interview product users, you can ask frequent customers you already know. Sometimes, you may need non-users. To find these individuals, consider using organizational memberships.

Select an organization with members who match the participant profile. This could be a business group, social or service club, civic organization, non-profit group, temple or mosque, or sports team.

You can also ask participants to recruit others with similar characteristics. The first participant is more likely to know someone like themselves than you are.

Defining the population of interest

A researcher studying the market potential for an updated Volkswagen Golf may need to consider various categories to define the target population clearly.

Possible categories:

- All car drivers

- Current Volkswagen Golf owners

- Owners of midsize hatchbacks

- Individuals who have previously shown interest in Volkswagen Golf models

- People likely to buy a car within the next 24 months

- People likely to buy a midsize hatchback within the next 24 months

The final definition of population:

- Car drivers who currently own midsize hatchbacks and are likely to purchase a replacement midsize hatchback in the next 24 months.

Quantitative Research

Quantitative research involves a large number of interviews. Typically more than 200, with many public studies reaching 1,000.

Quantitative research is usually used for market analysis, such as segmenting the market. It is also used to determine the likelihood of people purchasing a product or service.

Quantitative research can be costly with large samples. If good secondary data is available, conducting your own survey is rarely cost-effective. Do a small, fast, tailored survey to fill specific gaps.

Clearly define the information you need from the research. Avoid adding nice-to-have but unnecessary questions. Ask yourself if you really need the precise data from a survey.

If you manufacture medical a instrument, do you really need to state with precision that 49% of its usage is for auto accident victims, 29% for childbirth, 13% for gunshot wounds, and 9% for other cases?

What do you gain from this precise percentage? A few dozen visits would likely reveal that auto accidents, childbirth, and gunshot wounds are major applications. Maybe that’s enough for you to proceed.

How many participants do you need?

The number of interviews and their random selection dictates a study’s accuracy. It’s the absolute size of the sample that matters, not the proportion of the total population it represents.

Surveys of the general public typically involve around 1,000 interviews. This sample size yields results within a 3.2% margin of error compared to a full census (we can be 95% certain of this). The key is random selection. You need to ensure everyone in the population has an equal chance of being chosen.

Think of testing the water quality in a lake. You wouldn’t need to sample 10% of the lake’s water. By taking a few bucketfuls from different points, you can get a reliable picture of its water quality. Similarly, a well-chosen sample of people can provide an accurate snapshot of a population.

Imagine you want to find out what percentage of people in the U.S. eat breakfast every morning. You’ll get highly variable results in the first few interviews. However, after about 30 interviews, you’ll start to see a pattern.

By the time you reach around 200 interviews, you’ll find that 80-90% of respondents say they eat breakfast daily. Even with more interviews, this percentage remains fairly consistent.

Increasing the sample size yields diminishing returns. Doubling the sample from 500 to 1,000 interviews only improves accuracy from ±4.5% to ±3.2%. Ask yourself whether the additional cost is justified.

In business-to-business surveys, the population size is smaller than in consumer surveys. Here, samples are often chosen based on judgement. These surveys may involve fewer than 100 interviews but remain quantitative. The analysis focuses on measurements.

Surveys

You can conduct three kinds of surveys – personal survey, telephone survey, and online survey.

Personal surveys offer the advantage of visual prompts. You can physically show the participant your product. Telephone surveys often face low response rates. But it can reach specific groups and provide anonymity.

However, online surveys have become the leading method for quantitative research. These self-completion surveys are fast and efficient. They often take just minutes to administer. Online surveys greatly reduced the cost and increased the speed of quantitative research.

Google Forms is an excellent free tool for surveys. If you need more features and are willing to pay, SurveyMonkey is a great premium option.

Designing the questions

Designing survey questions is one of the most challenging and crucial aspects of conducting a survey.

There are three types of questions you can include:

- Behavioural questions

- Attitudinal questions

- Classification questions

Behavioural questions aim to understand actions. For instance, do people go to the movies? How often? What types of films do they watch? Who accompanies them?

You can use behavioural questions to determine what people have eaten, bought, used, visited, seen, read, or heard. They record facts, not opinions. Facts are more important. Opinions can change but behaviours tend to be stable.

People’s attitudes significantly influence their behaviour. Even though attitudes are more fleeting than behaviour, they are crucial for understanding emotions.

People deny how much their emotions impact their actions. They believe they are rational consumers guided by facts. However, emotions play a huge role in purchasing decisions, even for B2B buyers.

To explore attitudes, use questions that start with who, what, why, where, when, and how. You can also use exploratory phrases like:

- Would you explain …?

- Why do you…?

- What do you think of…?

- Which is best (or worst) for…?

Sometimes you may ask hypothetical questions like, “How likely would you be to try this product?” The responses may not be entirely reliable. Saying they are likely to buy is very different from an actual purchase involving money.

These answers are still valuable. They indicate which groups of respondents are interested in the product. You can target that group in your marketing.

Classification questions help build profiles of respondents by determining details like age, gender, social class, location, marital status, type of housing, and family size.

In B2B surveys, they classify the size of the company interviewed, its industry sector, the respondent’s occupation, the company’s geographical location, etc.

Keep your survey short to maintain participant motivation. However, don’t combine multiple questions into one to shorten the survey. Asking two questions at once can confuse participants and lead to meaningless answers.

There are three main types of questions based on their format for capturing responses:

- Open-ended questions

- Closed questions

- Scaling questions

Open-ended questions allow respondents to reply in their own words. For example:

What did you enjoy most about your flight?

This type of question can reveal insights the airline might not have previously recognized.

Closed questions require respondents to choose from a predefined list of options. For instance:

Compared to last year, do you visit this Tesco store more often or less often each week?

- More often

- Less often

You can also provide multiple-choice options.

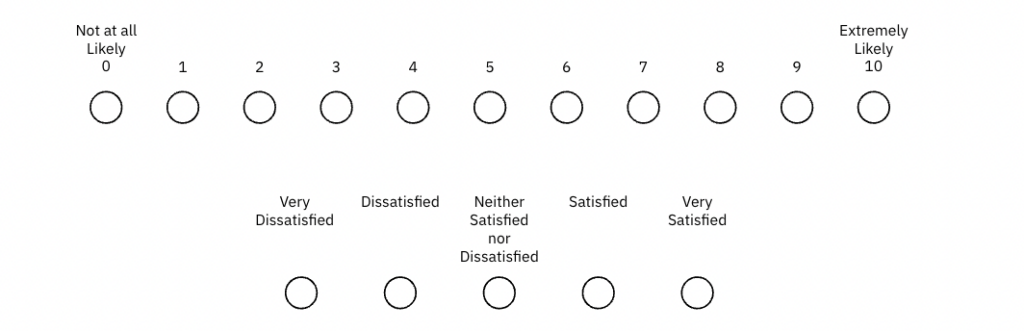

Scaling questions involve assigning numerical values to subjective concepts like attitudes, opinions, and feelings. For example:

- Rate how likely you are to recommend our hotel on a scale from 1 to 10, where 1 is not at all likely and 10 is extremely likely

- How would you rate your satisfaction with your stay?

Example of rating scales:

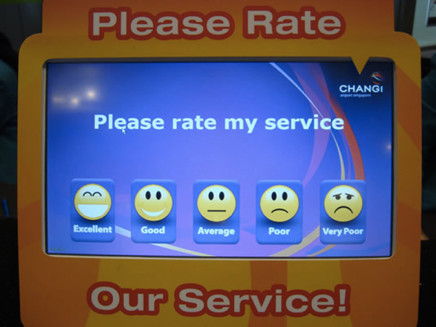

At Changi Airport in Singapore, they use smiley face emojis on touchscreens to gauge passenger satisfaction. This method effectively bridges the language barrier and allows respondents to quickly rate their experience.

Using panel companies for online survey

You need a database of email addresses to distribute the survey. Building a large email list from scratch is difficult. People are often hesitant to share their email addresses due to concerns about spam.

If you don’t have a customer database, you can use panel survey companies. They recruit individuals who want to participate in surveys.

Many people are willing to participate in market research surveys either because they enjoy answering questions or for a small incentive.

Face-to-Face Interviews

Face-to-face quantitive interviews involve meeting respondents in person and using a questionnaire to conduct the interview. This method can be categorized into in-home/doorstep, executive, and street interviews.

Face-to-face interviews offer some advantages over telephone and self-completion surveys. It’s typically easier to motivate respondents to take part. It’s also easier to obtain answers to difficult questions.

The main drawbacks are the higher costs and the time-consuming nature of face-to-face interviews.

Executive interviewing

Executive interviewing is the B2B version of in-home interviews. It involves interviewing professionals at their workplace about industrial or business products and services.

Conducting executive interviews is a complex affair. You need to identify and locate the individuals responsible for purchasing. This often requires calling organizations and navigating through various departments to find the right person.

Once identified, you need to secure an interview. If you can speak directly to the target respondent, this may be straightforward. If you have to go through their secretaries, the task can become challenging and time-consuming.

Receptionists and secretaries often respond with phrases like, “She’s busy,” “He’s in a meeting,” “He won’t have time to see you,” or “Call back in a couple of weeks.” If you manage to reach the target respondent, they are often eager to discuss their work.

Street interviewing

Street interviewing involves approaching people while they are shopping. You can interview them on the spot or direct them to a nearby location.

Street interviewing remains popular because it is much cheaper than in-home interviews. You don’t have to waste time visiting homes where no one is available.

Exit surveys are a type of street interview. They involve interviewing people as they leave a venue to gather feedback on the facilities and their experiences. Major retailers also do this within their stores. They ask about their brand, products, or services.

I hope you have found my guide on market research helpful. If you have any questions, feel free to contact me.

Many of the examples and questions in this article are sourced from Paul Hague’s Market Research in Practice and Prof. Alan Wilson’s Marketing Research: Delivering Customer Insight. These books are not aimed at small business owners. But if you have an academic interest or want to start a career in market research, I recommend them highly.